Why Good Credit is Crucial for Student Loan Borrowers

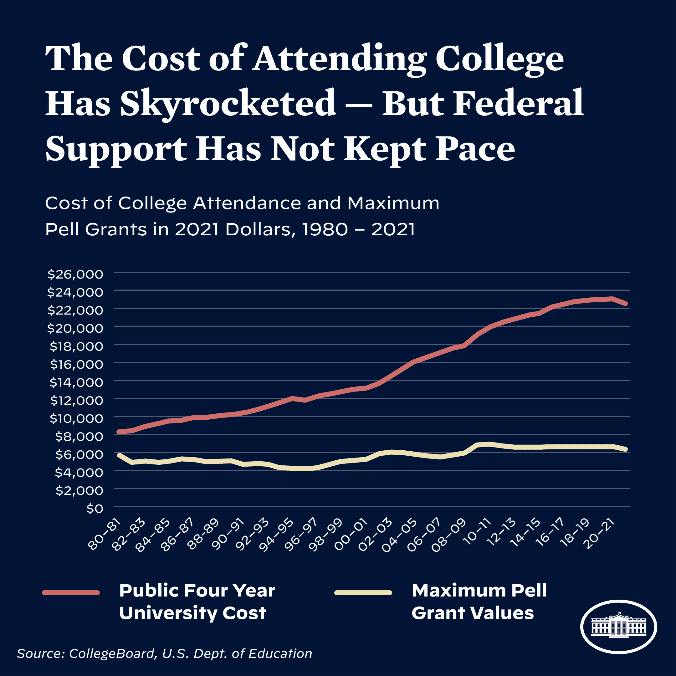

Higher education can be expensive, and for many students, taking out student loans is often the only way to finance their education. According to our data for the 2020-2021 academic year, the full cost of attending school (tuition, fees, and room & board) was $50,770 at private colleges and $22,180 for state residents at public colleges.

Not everyone has a 529 Savings Account or qualifies for scholarships that can help pay for these increasing education costs. As a result, many students are forced to take out significant loans to pay for their education, which can lead to substantial debt upon graduation.

Below, I explore why good credit is crucial for student loan borrowers and how it can impact interest rates, loan approval, and the ability to ultimately qualify for loan forgiveness programs.

Interest Rates and Student Loan Approval

When applying for student loans, lenders will look at your credit score to determine your creditworthiness. A credit score is a numerical representation of your credit history and is used by lenders to determine the likelihood of you repaying your loan on time. The higher your credit score, the more likely you are to be approved for a loan, and the better the interest rate you will receive.

Having a good credit score is crucial when it comes to student loans because it can significantly impact the interest rate you are offered. According to a report by the Consumer Financial Protection Bureau (CFPB), borrowers with excellent credit scores (above 720) receive interest rates that are 3-4 percentage points lower than borrowers with poor credit scores (below 640). Over the life of the loan, a difference of 3-4 percentage points can add up to thousands of dollars in savings.

When I was applying for student loans to pay for my undergraduate degree, I knew that having good credit was essential to receiving a favorable interest rate. I had been working part-time throughout high school and college and had been building my credit for a few years. As a result, I was able to receive a lower interest rate on my student loans than what some of my peers were offered. This lower interest rate saved me thousands of dollars in interest payments over the life of my loan, and it was all because I had good credit.

Maintaining Good Credit While Paying on Student Loans

For student loan borrowers who want to improve their credit score while repaying their loans, there are a few practical tips that can help. One of the most important factors in maintaining a good credit score is making payments on time. Late payments can quickly lower your credit score and make it more difficult to obtain credit in the future. It’s essential to make payments on time each month to avoid any negative impact on your credit score.

Another critical factor to consider is your debt-to-income ratio. This is the amount of debt you have compared to your income. If you have a lot of debt relative to your income, this can negatively impact your credit score. To improve your credit score, it’s important to manage your debt-to-income ratio by paying down your debts and avoiding new debts whenever possible.

In addition to these practical tips, there are also resources available to help student loan borrowers manage their credit and finances. Credit counseling services can provide guidance on how to improve your credit score and manage your debts, while financial planning services can help you develop a budget and set financial goals. By taking advantage of these resources, borrowers can better manage their student loan debt and improve their overall financial well-being.

Qualifying for Loan Forgiveness Programs

In addition to impacting interest rates and loan approval, having good credit is also crucial when it comes to qualifying for loan forgiveness programs. Loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness, can help borrowers reduce or eliminate their student loan debt, but they often require borrowers to meet specific eligibility criteria, including having good credit.

The PSLF Program

For example, the Public Service Loan Forgiveness program is available to borrowers who work full-time for a qualifying employer, such as a government agency or non-profit organization. To qualify for loan forgiveness under this program, borrowers must make 120 qualifying monthly payments while working for a qualifying employer. However, if a borrower falls behind on their payments or goes into default, they may no longer be eligible for loan forgiveness. This is where having good credit comes in. Borrowers with good credit are more likely to make their payments on time and stay in good standing with their lender, which is essential for qualifying for loan forgiveness programs.

President Biden’s Loan Forgiveness Bill

While not yet signed into law, in August 2022, President Biden delivered a three-part plan that promises to cancel $10,000 of student debt for low- to middle-income borrowers. It is currently sitting with the US Supreme Court to see if the plan can proceed as planned.

One of the main benefits of this plan is that it would provide up to $20,000 in debt cancellation to Pell Grant recipients with loans held by the Department of Education, and up to $10,000 in debt cancellation to non-Pell Grant recipients. Borrowers who are eligible for this relief would need to have an individual income of less than $125,000 ($250,000 for married couples). No high-income individual or high-income household, in the top 5% of incomes, will benefit from this action. This means that those who are struggling to pay off their loans and are in genuine need of assistance will be the ones who benefit the most from this plan.

Another significant benefit of this plan is the extension of the pause on federal student loan repayment until December 31, 2022. This will provide much-needed breathing room for borrowers who are still grappling with the financial effects of the pandemic. By extending the repayment pause, borrowers will not be forced to resume payments until they have had time to recover financially, reducing the risk of unnecessary defaults.

The plan also aims to make the student loan system more manageable for current and future borrowers. The proposed income-driven repayment plan would cut monthly payments in half for undergraduate loans and cap monthly payments at 5% of a borrower’s discretionary income. This would provide significant relief to borrowers struggling to make ends meet, allowing them to free up more of their income for other essential expenses.

In addition, the proposed changes to the Public Service Loan Forgiveness (PSLF) program would fix a broken system that has been a source of frustration for many public servants. By improving the PSLF program, borrowers who have worked at a nonprofit, in the military, or in federal, state, tribal, or local government would receive appropriate credit toward loan forgiveness.