Lock in Today’s Prices: A Guide to Tuition Prepayment Plans

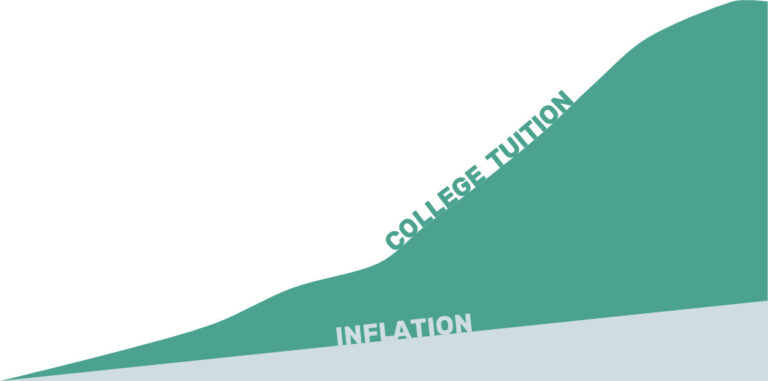

The cost of higher education in the US has been rising for decades, and the trend shows no signs of stopping. According to the College Board, the average cost of tuition and fees for the 2021-2022 academic year was $37,280 at private colleges, $10,560 for state residents at public colleges, and $27,020 for out-of-state students attending public universities. And this is just for tuition costs. If you add up all the costs associated with going to college (room & board, tuition, and fees), it almost doubles.

Prepaid tuition plans are one way to combat the rising costs of higher education. By prepaying for future college tuition, families can lock in today’s prices and avoid future tuition hikes.

Planning ahead for college costs is crucial to avoid the stress of not being able to afford college tuition. Families who start planning early have more options and can take advantage of programs like tuition prepayment plans.

What is Tuition Prepayment?

Tuition prepayment plans are programs that allow families to pay for college tuition at current rates, even if the student will not be attending college for several years. The funds are usually invested in stocks and bonds, and the earnings on the investments are used to pay for future tuition expenses.

There are two main types of tuition prepayment plans: state-sponsored plans and private plans. State-sponsored plans are typically only available to residents of the state, while private plans can be used by anyone. States sponsor prepaid tuition plans because they are well aware of the increasing future tuition costs.

Tuition prepayment plans work by allowing families to make payments over time or in a lump sum. The payments are invested in a portfolio of stocks and bonds, and the earnings on the investments are used to pay for future tuition expenses.

One of the primary benefits of tuition prepayment plans is that families can lock in today’s tuition rates, even if tuition increases in the future. By locking in current tuition rates, families can avoid future tuition hikes, which can be significant. Tuition prepayment plans provide peace of mind for families who want to ensure that their children will be able to afford college. Tuition prepayment plans offer a variety of options to meet the needs of different families, including payment plans, investment options, and restrictions on the use of the funds. Tuition prepayment plans offer tax benefits, including state tax deductions and federal tax exemptions, for qualified expenses.

Tuition prepayment can also be coupled with other college savings plans like a 529 account. A 529 account can then be used to help pay for any other educational expenses once your child heads off to school. 529 plans have excellent tax advantages, which help reduce the cost of college even further.

How to Choose a Tuition Prepayment Plan

To choose a tuition prepayment plan that suits their needs, families should follow a few key steps. First, it’s important to research and compare different plans to determine which one offers the best fit. This includes considering the mandatory fees and investment options associated with each plan to find the best value. Families should also take a closer look at the restrictions and limitations of each plan, such as enrollment requirements, age limits, and residency requirements.

Finally, it’s crucial to evaluate the level of risk associated with each plan, including the investment strategy and the financial stability of the plan’s administrator. By following these steps, families can make an informed decision and choose a tuition prepayment plan that provides peace of mind and financial security.

Examples of Tuition Prepayment Plans

As of September 2021, there are only 11 states that offer prepaid tuition plans: Florida, Illinois, Maryland, Massachusetts, Michigan, Mississippi, Nevada, Pennsylvania, Texas, Virginia, and Washington. However, some of these plans are currently closed to new enrollment.

- Florida Prepaid College Plan – This is a state-sponsored tuition prepayment plan that allows families to lock in today’s tuition rates for future college expenses at a Florida public college or university. The plan offers several options, including a 4-Year Florida University Plan, a 2+2 Florida Plan, and a 1-Year Florida University Plan.

- Private College 529 Plan – This is a tuition prepayment plan that allows families to save for future college expenses at participating private colleges and universities. The plan is not state-sponsored and does not lock in tuition rates, but it does allow families to purchase “units” that can be redeemed for a set amount of tuition in the future.

- Maryland Prepaid College Trust – This is a state-sponsored tuition prepayment plan that allows families to lock in today’s tuition rates for future college expenses at a Maryland public college or university. The plan offers numerous options, including a 4-Year Plan, a 2-Year Plan, and a Community College Plan.

- Virginia529 Prepaid Plan – This is a state-sponsored tuition prepayment plan that allows families to lock in today’s tuition rates for future college expenses at a Virginia public college or university. The plan offers several options, including a 4-Year Plan, a 2-Year Plan, and a Community College Plan. It is permanently closed to new enrollment due to exceedingly high demand when it first opened.