Average 2021 College Costs Increase as More Families Struggle Financially

The cost to send your child to college is getting more expensive next year, even as the pandemic rages on and families continue to struggle.

The 2020-2021 school year’s costs are expected to rise by over 1.3% on average from their 2019-2020 record highs.

| School Year | Public two-year (In-District) | Public four-year (In-State) | Public four-year (Out-of-State) | Private Nonprofit Four-Year |

|---|---|---|---|---|

| 2013-14 | 10,781 | 18,383 | 31,721 | 40,955 |

| 2014-15 | 11,192 | 18,931 | 32,893 | 42,445 |

| 2015-16 | 11,370 | 19,570 | 34,220 | 43,870 |

| 2016-17 | 11,640 | 20,150 | 35,300 | 45,370 |

| 2017-18 | 12,040 | 20,790 | 36,480 | 46,990 |

| 2018-19 | 12,350 | 21,400 | 37,390 | 48,290 |

| 2019-20 | 12,690 | 21,950 | 38,280 | 49,870 |

| 2020-21 | 12,850 | 22,180 | 38,640 | 50,770 |

Costs – which include tuition, fees, room and board – have increased by roughly 25.3% at private colleges and about 29.8% at public colleges since 1978-79.

At least research suggests that the cost of college is worth it. In 2018, college graduates earned weekly wages that were 80% higher than those of high school graduates. The Bureau of Labor Statistics reports that Americans with a bachelor’s degree have median weekly earnings of $1,173, compared to just $712 a week for those who only have a high school diploma.

Families Continue to Struggle Financially

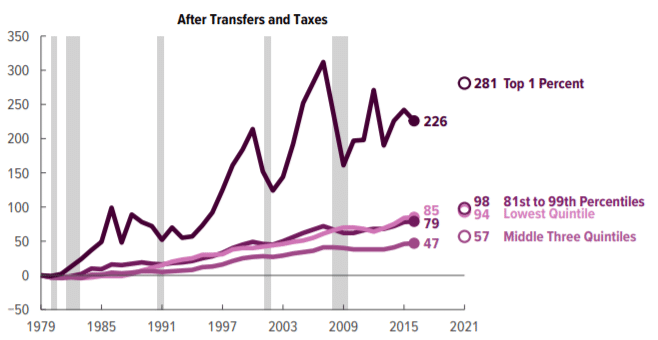

The Congressional Budget Office – or CBO – in 2019 published a report that projected the changes in the distribution of household income by 2021 from 2016 numbers.

The CBO predicted that 2021 family income would increase about 1-1.5% over the 5-year span.

By comparison, college costs increased 14.1% over the same time period.

The COVID Financial Hit

Despite the one-time stimulus direct-pay $1,200 check in April as well as the potential $600 one in December, families are still struggling. These one-time payments are meager compared to the losses they are seeing financially as many are losing their jobs entirely.

58% of the adult respondents to a Congressional Research Study said they were in households that lost employment income since March due to the impact of COVID. About half of Black or non-Hispanic respondents said they were in households that lost employment income.

As families lose household income, savings are naturally the first to be cut out of their budgets. Seeing as the average amount of funds within 529 accounts dropped in 2019 by over $400, this is only expected to be amplified as 2020 numbers are released.